apologies for the lack of a report at the weekend but im off on holidays soon for a week and just had too many things to do..

First tho to let you know that my Grailtrading Blog has been updated with the results for October 2005.

during the week ill send some trading updates and thoughts with the email publisher.

all the best for now.

The ravings of a mad forex trader and his twisted view on the world we live in

Monday, October 31, 2005

Saturday, October 22, 2005

Week - Ending 21/10

been a tricky week for Hilda and a good week also - had several great days on the system, I however spent 3 days of it trading a long on cable that started Wednesday afternoon and finished Friday for +162 pips. Add that to the early week results and I took +227 for the week. Did suffer some losses this week though and Hilda's stats for October have dropped to 75% on the one and five min charts

Lets have a look at my weekly lottery guesses lol

I said that on Monday / Tuesday we should see a test of the trendline at 7600-7620 which it did - but then it continued and broke the 7570 area - when it did this it did indeed continue for more downside until Tuesday when we saw a close double bottom at 7420 - I didn't expect the downside move to go that low at all

I gave a sticking point of 7810 for the upside move and it stopped short of that at 17998 on Friday before the drop.

Ok, lets have a look at the coming week.

On Sunday / Monday I see a rise to begin with pausing for breath at 7720 ish - this is a crux number - if she breaks to the upside then we will see new highs and the start of an uptrend.

Before this happens I see price playing a game of ping pong between 7720 and 7640 / 7601 but it may well just go for the break immediately

Before this happens I see price playing a game of ping pong between 7720 and 7640 / 7601 but it may well just go for the break immediately

so - two scenario's

If we head north:

topside first resistance seen at 7820, 7997, 8110 and finally 8377

if we head south:

support seen at 7610, 7594, 7560, and then a clear run to 7250

hope you've had a good week

As usual this analysis is for entertainment purposes only - trade what you see :)

From The Desk Of ...

Soultrader

Monday, October 17, 2005

Monday - what a day!

Well, for a Monday it's been a hell of a day hasn't it. Long one for me though and started very early.

In fact I couldn't sleep at all last night - I had the usual Sunday afternoon nap which just went on far too long and when it came time to go to bed I was wide awake. So, with the wife happily snoozing upstairs I opened my charts - the market seemed to be moving well and I caught a reversal from 1.7651 to 1.7705 for 20 pips and then went long from 81. closed that one too early though for just 8 pips to give me a total of 82 before bed - decided to quit whilst I was ahead and get some sleep.

then I overlaid and it was 8:30 before I got to the pc.

I made the dreaded mistake that most traders do and thought I was well in 'the zone' and proceeded to give back 34 of the pips I'd made - well, you know the story.

before I really got into self destruct (yes, we all do it) I took a break for a while and came back to start regaining them. tentatively I took a short from 7591 and got em back plus a bit more - although I did close too early.

for the day its +87 and I'm retiring happy that at least I didn't give the whole lot away!

Everyone is starting to feel the market might go long now, but we are expecting lots of bad news out of the UK this week so don't hold onto any beliefs that the market has had enough of short. - just a heads up is all, trade what you see not what you think :)

back tomorrow

From The Desk Of ...

Soultrader

Saturday, October 15, 2005

Blog Notes

Note that from now on I will no longer be providing specific trade by trade analysis of the hilda signals as this is done daily in our trading room as the day unfolds. I may also be working on a members area of the http://www.simpleforexsystems.com site to log the trades for system users to check.

The blog will be returning to its former use as daily thoughts and comments on the market with overviews on trades taken for each day.

The past week has been a brilliant trading week for me personally. Lots of trends in both direction as the market begins to make its mind up to whether to initiate a trend change or not.. Its been that elusive one week a month when ive been really in tune with the market. I'm sure that this happens to you also, you know what I mean? everything just drops into place and you cant go wrong.

I'm not saying I haven't had losing trades but they have been very few and far between. As I trade mainly using a one minute chart to pinpoint entries its very easy to see when you've got it wrong and exit very quickly. I cant remember the last time that I had a loss of more than 10 pips on a singe trade trading in this way (note that this statement does not include the trades off the grail system)

My results for the week are +218 pips for 28 trades, 21 of which were winners for 270 pips and 7 losers for -52 pips which gave me a personal win / loss ratio of 75% and an average of 8 pips per trade after spread.

In the room this week I concentrated on training a specific trading setup on a one minute chart. This subject will again be the main thrust this coming week as it's imperative that this one thing is embedded into our traders minds. Ill continue to hammer this home until the users recognise this happening automatically as it is core to taking safe entries from signals given on the higher timeframes.

If you are a member of the group reading this then you'll know what I'm referring to and for those who cant get to the room I will try really hard to deliver our 4th video this week which will concentrate on this setup.

The Week Ahead

Friday finished with the four hour and daily charts breaking their trendline which has been in place for a month now since 12th September and the good news is that the day closed above it.

The next step in this potential trend change is for the trendline to be tested. This should result in a drop sometime Monday or Tuesday to test the break level around the 7600 - 7620 area. Its possible price could go as low as 7570 before a bounce up - if it doesn't bounce from this area then we should see more downside however I don't think this will happen.

following the test we should see a rise with a potential sticking point around 1.7810 - 20 as cable struggles to break the highs of 6th October. Next potential sticking point is around the 7880 level and 7905 will be very difficult to break.

if we see 7950 this week then it should be a good setup to see price rise to 8330 next week.

as usual please note that these are not trading recommendations and you are responsible for your own trading decisions

That's it from me today - have a great weekend.

From The Desk Of ...

Soultrader

Saturday, October 08, 2005

Oct week one

been a very hard week for me this week. broken pc, pc rebuild and its amazing how many small pieces of software that you add to make life easier isnt it - took a bloody age to get most of em loaded.

Im probarbly about 60% of the way there but enough to continue business 100% now anyway - the rest will be added as and when i need em.

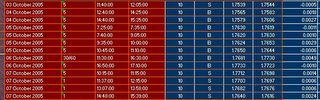

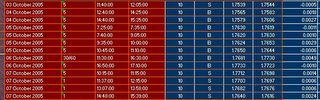

hilda signals from this week are below - bit of a tough week to trade but ive identified and trained the users on am easy way to trade the 1 min chart in a ranging market.

Hilda has an easy way of identifying a ranging market and also tells you when one is forming. as the market ranges most of the time then it was a good idea to find a way to range trade it. This appeared in the form of a pattern and hilda combination so this week im going to concentrate on this in the training room and also get another video done for it.

Lets look at my predictions from last week:

i said ...

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

well, the prediction for the rise was correct although my first barrier was broken the prediction of 1.7800 was within 13 pips of the weeks high (it reached 1.8013) this took longer than i expected as i did say tuesday - however the fall finally came on Thursday and did indeed make new lows so i think i was pretty damn good on that one :)

the week ahead:

The weekly chart ended on a doji so based on that it's anyones guess as to where the week will end. The monthly chart is still set for an upmove but not to new highs - this will take about 3 or 4 months to complete taking us to february in the new year. 1.8663 is my prediction for a top on the next swign up on the monthly chart - lets see at the beginning of 2006.

The daily shows more downside to the week ahead making new lows again possibly this week down to 1.7300.

The 4 hour chart suggests a rise to 1.7679 on monday before the downside for the week drops into place.

thats it, lets see what happens :)

Obviously the analysis on this page is merely for entertainment purposes only and should not be taken as investment advice - in other words its most probarbly bollocks. :)

take care and check in during the week.

Im probarbly about 60% of the way there but enough to continue business 100% now anyway - the rest will be added as and when i need em.

hilda signals from this week are below - bit of a tough week to trade but ive identified and trained the users on am easy way to trade the 1 min chart in a ranging market.

Hilda has an easy way of identifying a ranging market and also tells you when one is forming. as the market ranges most of the time then it was a good idea to find a way to range trade it. This appeared in the form of a pattern and hilda combination so this week im going to concentrate on this in the training room and also get another video done for it.

Lets look at my predictions from last week:

i said ...

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

well, the prediction for the rise was correct although my first barrier was broken the prediction of 1.7800 was within 13 pips of the weeks high (it reached 1.8013) this took longer than i expected as i did say tuesday - however the fall finally came on Thursday and did indeed make new lows so i think i was pretty damn good on that one :)

the week ahead:

The weekly chart ended on a doji so based on that it's anyones guess as to where the week will end. The monthly chart is still set for an upmove but not to new highs - this will take about 3 or 4 months to complete taking us to february in the new year. 1.8663 is my prediction for a top on the next swign up on the monthly chart - lets see at the beginning of 2006.

The daily shows more downside to the week ahead making new lows again possibly this week down to 1.7300.

The 4 hour chart suggests a rise to 1.7679 on monday before the downside for the week drops into place.

thats it, lets see what happens :)

Obviously the analysis on this page is merely for entertainment purposes only and should not be taken as investment advice - in other words its most probarbly bollocks. :)

take care and check in during the week.

Thursday, October 06, 2005

Sorry!!

Well, ive just setup the blog so I can just email to it - should be cool but I don't think that pictures work.

Ive not had chance to hardly trade or make any reports in here - On Tuesday morning I came into the office to find that the motherboard and processor was totally fried on my main pc.

No, email, no trading, no nothing.

so had to go and buy a new pc from the wholesaler and then spend the rest of the time installing etc - that's what ive been doing - no fun I can tell you. The pc had been used for 2 years now and it's amazing how much stuff you find to make life easier so its been murder getting it all on.

I'm about half way through it now but still a shedload to do - some will have to wait until I actually need em - who said computers made life easier????

Soultrader

Saturday, October 01, 2005

Month End

Stats for the Month of September are below.

Before i analyse those and cover last weeks predictions just to let you know that the grailtrading blog has now been updated here

Ok, so last weeks predictions - how did they do?

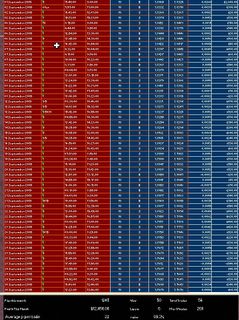

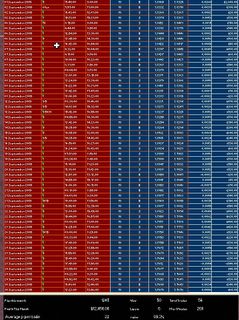

Before i cover next weeks prediction lets have a look at the hilda signals log below. September was a great month and the addition of the new trade setup has indeed increased the win / loss ratio of hilda. Important thing to note is that this is only an addition and those of you trading hilda should not disregard the basics of the core system.

1245 pips for the month and an 89.3% winning ratio on what i call 'low hanging fruit' trades.

Hopefully you can see the sheet below by clicking on it - afraid i had to zoom out somewhat to get them all on one screen

Ok, onto the week ahead then.

The daily chart suggests to me there well may be more downside to the start of the week, although the chart is fighting one of the indicators in use. The weekly is showing signs of flagging but still has the potential to more downside.

We have a new monthly bar on the monthly chart which does show a setup for long. However price is in the 'dead zone' as i call it and so could in effect go either way. However if i had to make a prediction and throw my hat in the ring i would say that October will finish the month higher and a close to the month above 1.82 would signal that the current downtrend is over and the monthly uptrend will resume.

So, the week ahead

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

there is an upmove on the cards and this week may be a hard week for intraday trading as we are at a decision point wether to initiate the move this week or next week.

Of course this analysis is all bollocks and no-one can truly predict the market - so please dont take any of this as anything more than a bit of fun - trade what you see as it unfolds :)

Hope you have a great week ahead

Before i analyse those and cover last weeks predictions just to let you know that the grailtrading blog has now been updated here

Ok, so last weeks predictions - how did they do?

- a possible retrace to 1.7910 - tuesday - way off the mark - market did retrace but only to 1.7800

- new lows should follow any lift - correct

- Possible lows of the week 1.7350 - way off the mark 1.7565

- possible highs 1.8120. - again way off the mark

Before i cover next weeks prediction lets have a look at the hilda signals log below. September was a great month and the addition of the new trade setup has indeed increased the win / loss ratio of hilda. Important thing to note is that this is only an addition and those of you trading hilda should not disregard the basics of the core system.

1245 pips for the month and an 89.3% winning ratio on what i call 'low hanging fruit' trades.

Hopefully you can see the sheet below by clicking on it - afraid i had to zoom out somewhat to get them all on one screen

Ok, onto the week ahead then.

The daily chart suggests to me there well may be more downside to the start of the week, although the chart is fighting one of the indicators in use. The weekly is showing signs of flagging but still has the potential to more downside.

We have a new monthly bar on the monthly chart which does show a setup for long. However price is in the 'dead zone' as i call it and so could in effect go either way. However if i had to make a prediction and throw my hat in the ring i would say that October will finish the month higher and a close to the month above 1.82 would signal that the current downtrend is over and the monthly uptrend will resume.

So, the week ahead

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

there is an upmove on the cards and this week may be a hard week for intraday trading as we are at a decision point wether to initiate the move this week or next week.

Of course this analysis is all bollocks and no-one can truly predict the market - so please dont take any of this as anything more than a bit of fun - trade what you see as it unfolds :)

Hope you have a great week ahead

Subscribe to:

Posts (Atom)