So, firstly thanks for all the well wishes and i appreciate em all except Baruch - he can piss off and drop from a great height LOL dickhead.

Denham nice to know you are still around, Todd thanks for the birthday message for grail and etc etc to the others :) Beer in NYC, hmmm not sure - when you hear what i think about your poor excuse for a president you might not want to :)

And Jonkris, nice to hear from you mate - another satisfied hilda buyer :) Hope you enjoy what's to come.

Before I start wittering on about trading and shit you may want to check out the grail blog which has just been updated.

So, what am i going to whitter on about on this blog. Guess i'd better tell you what i'm playing with at the moment.

Myself and a friend opened a MIG account purely with the intention of experimenting on systems and shit. we opened it with $18k (£10k) and have just played with potential systems - we played with firebird for a month or so which is a bag of crap - I developed one called Predator which was a bag of crap and at one point the account was drawn down to less than $7k LOL - but then that's what the account was for.

Anyway, a month later and some canny discretionary trading and the account now stands at $20k+ so it's time to play again.

This time I am looking at a breakout system of trading which is discretionary but is aided by an expert advisor.

So, let me explain to you how i'm doing this and how most do this.

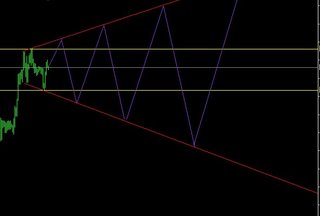

lets have a look at a chart shall we.

This is the way most people identify a breakout and place orders. This particular example is NZDJPY today and although it aint the best example its the best i can do at the mo.

So what they do is place a long $10 @ 78.97 and a short @78.45

eventually one will trigger and they will close the opposite order. The stop they will generally place about 10 pips lower that the opposite breakout.

Ok, and that's fine - you would actually make money that way albeit sporadic. Breakout trading is a great way of trading - why? because it uses no indicators and only recent support / resistance - it's a price based system.

so, how do I do it different?

Well, firstly i dont go in 100% at the first break. Think about this - a lot of breakouts are false positives - ie they break out but then drop back into the range or worst case scenario they totally reverse and stop out your position -you then have a full stop out and sit there wondering if you should go the opposite way and miss the boat.

So my approach (and bear in mind this is merely an experiment that you are a part of) is that I build into a position $1 at a time. - this will be easier to show on a chart.

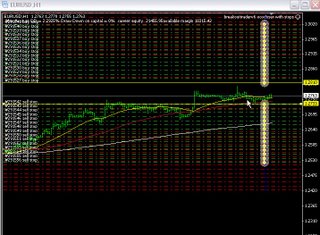

This is EURUSD on a 1 hour - I identified this range this morning and plonked the figures into my expert.

My expert then places 15 trades north and 15 trades south starting at the figures I specified. - the white line is a 200sma by the way - if i fancy a smaller timeframe breakout then i'll look on the 5 min for a chart where price is bouncing above and below the 200sma - that really will be a breakout as the market has no direction.

anyway, the 15 trades are all 0.1 lots each so lets analyse this - first though i'd better tell you exactly what the expert does - then you can build your own if you like

i put into the expert the hibreak and lobreak points - i decided on how many trades long and how many short and i decide how many pips between the entries. i can also decide a take profit if i wish and another 2 inputs - 1 of which is how many pips past the opposite entry the stop should be and finally an 'oco' closer - in other words if the trade goes in long then how many pips does it go long before the expert cancells the opposite breakout trades.

Got me so far?

so - here's the scenario using the euro chart above. - its placed 15 trades north and south - each trade is 15 pips apart and each trade has NO take profit. The stop for all the north trades are 20 pips below the south breakout level and vice versa for the south breakout trades.

whichever direction price breaks in, once it is 20 pips into profit it will close all opposite orders.

so, here are the scenario's of what can happen

Scenario 1

price breaks north or south - places 1 trade at $1 a pip, goes another 15 pips and places 2nd trade @$1 a pip - goes another 5 pips and cancells allopposite orders. cantinues to go in same direction. When trader happy all trades are closed by using expert no2 which just closes anything it sees on that pair.

Scenario 2

Price breaks and places a trade - goes another 15 pips and places trade 2 - price now retraces and goes the opposite way - you are at this point only $2 a pip as opposed to the normal breakout trader who is full in. Trade reaches opposite breakoutand enters one of your positions is no hedged. it continues another 15 pips and enters a second opposite position - you are now fully hedged. - price retraces here back into the range - you have a constant loss here and are waiting for a breakout again.

Price continues in direction 2 again this time going a further 5 pips which hits the stops on direction 1 AND closes all direction 1 orders - you have just taken a loss of $2 a pip on the first breakout BUT the second breakout is now in profit and running. Trade is closed when losses from breakout 1 are realised and some profit is made - basically discretion.

Scenario 3

This is the nightmare scenario and the worse that can happen - it does happen too and relatively often but how often we shall see as this experiment progresses.

The worst thing that can happen is this - breaks north 15 pips - reverses south and goes south 20 pips+ then reverses north again stopping out the south trades - then you have 4 trades on a full stopout the size of which is dependent of the size of the range. Probarbly about 60 pips top to bottom so 60*$4 = $240.

Think of the average breakout trader who is in $10 a pip - he just lost $600 one way and $1200 both ways if he plays that way.

So, there are several ways of playing this with regards to stops and oco cancels.

you could just have no stop and no oco - that way she goes north and takes you in say 4 positions and then reverses and takes you in say 12 positions and eventually makes more than it is losing. - this sounds great doesnt it - basically for you to lose money the following has to happen.

Now you prob think "there's not much chance of that" - well, think again - it happens often and the worse thing about it is that when you are in both ways you have to have a move double the range just to get break even. so if you have a 100 pip range that you are in from top to bottom you have to have a 200 pip rise from the top / bottom breakout to make money!

Anyway, absorb this and ask any questions you may have - im knackered now, been writing for ages and I haven't got a fucking clue why i'm doing this again?????

No comments:

Post a Comment