sorry for the lack of posts folks - been megabusy here and had a new tv delivered yesterday.

ill try and get the sheet updated for the month but ive had all on getting the new trade setup ready for the hilda group.

before you ask, no, its not changing just that ive identified a new trade setup for the 1 min chart that makes taking pips like shooting fish in a barrel.

im currently over 300 pips up on the day, 140 of which have been taken with this method. Needless to say im a happy chappie :)

The ravings of a mad forex trader and his twisted view on the world we live in

Wednesday, August 31, 2005

Friday, August 26, 2005

looong weekend :)

ok, time for some fun then, On Monday it's bank holiday in the UK which also happens to co-incide with our 22nd wedding anniversary tomorrow.

We are having a long weekend of fun and frolics :)

cant post up yesterdays trades cos for some reason bloggerbot is down. needless to say tho we had some good entries.

I wont be back on board until Tuesday at the earliest and chances are that the day will be manic with my other business so dont expect much from me on Tuesday. back in full force on Wednesday though :)

Have a great weekend ..... we will :)))

Thursday, August 25, 2005

Learning to lose

Hi Folks, I found this article on a forum today and liked it so much i asked to reproduce it here. I think this may change a slight paradigm in your thought processes when you get to the end :)

Learning how to loose is one of the most powerful skills that a trader can possess.

“Ah! Yes I know what you mean…every losing trade takes you closer to the next winning trade” Well…this is one of those sayings that seem to have an ‘air of wisdom’ about them and like I said in the heading, “trading sayings are dangerous”

Traders suffer an 80/90% failure rate, that is they start trading, learn a bit about technical analysis and then set about trying to devise a way to avoid losing, in an attempt to make money.

Some of them master this completely, by becoming so paranoid that they don’t place any trades at all, or just miss endless trading opportunities.

Making losing trades is vital to your success as a trader, without them you simply cannot advance at all.

So, how do you approach the task of making consistent controlled losing trades?

The first part is acceptance. Successful traders have accepted at a subconscious level that losing is on exactly the same scale as wining. Once this shift has taken place within the trader it will have a profound impact upon your trading results. It will set you completely free from any emotional attachment to that trade.

Side note:

Most traders try to detach themselves by endless strategy development, via the change or trimming of ‘perceived’ trading indicators. This is at best a waste of time if the subconscious is not involved in the process.

So how does a trader persuade the subconscious to accept this completely alien concept?

Well first we need to understand a little of what is going on in this truly amazing part of us located between our ears called the subconscious.

One role of the subconscious is the fight or flight response, that is; do you stand and fight or do you take flight?

This fight or flight response is a survival mechanism that kicks in EVERY time you are in a ‘threatening’ situation.

For the trader this is where 90% of the problems lie, because if any aspect of your trading causes even the most minute reaction, to the automatic fight or flight response, the chemical reactions start to kick in and you are lost in a sea of indecision and fear.

Think of it like this; imagine jumping out an aircraft with a lump of silk attached to your back for the very first time, then fast-forward to jump number 1,000

On jump 1,000 you would have having a wonderful time, maybe even a few tricks on the way down.

The point I am trying to make here is that when the situation you are in, is a know quantity, for example you are ‘comfortable’ with the outcome, then and only then are you free to experience fully the moment you are in, or the action you are carrying out.

The difference between making 1,000 parachute jumps and taking 1,000 trades, is crucial to understand, the difference is one of constants, when jumping there will always be a set of constants. With trading EVERY trade outcome will always be a variable.

This means than unless you persuade your subconscious that these variables are completely NON threatening, you will always be disadvantaged as a trader because of the chemical reaction of the fight or flight response.

There are two ways in which the trader can take positive actions to remove this ‘threatening’ concept form his/her trading. Today I will deal with just one, as the other way warrants a complete and detailed explanation in its own right for which we do not have the room here.

Removing all threatening aspects from your trading.

The trader needs to devise a plan, not to win trades, but how to lose trades trade in a controlled manner. The losing should take place in a systematic and repeatable method for every trade.

Now before you think I have gone barking mad here, I want you to really think about the trades you have taken to date.

I want you to be totally honest with the answer to the question. “Did you KNOW for certain that any one of the trades you took was going to produce a profit?”

If you answer yes to this question then I know already you are not a very successful trader. Because there is not a successful trader in the world that KNOWS his/her trades are going to be profitable. Your ego may like to think you knew but the fact is you did not.

A consistently profitable trader is a trader that treats every trade the same at a subconscious level, that is, the trading opportunity just holds an equal possibility of loss or gain; nothing more than this.

The successful trader is NOT looking for winning trades, because they don’t exist, (they only exist historically) the successful trader is looking for opportunities to put his trading plan into action.

So in summary then.

1.

Devise a plan how to lose trades in a controlled and consistent manner.

2.

Ensure that you can live with this plan in terms of draw down and any other relevant aspects of the plan

3.

Now in your imagination play this plan out to see how it feels.

4.

Now play this plan out over your next 15 trades as if they are all losing trades

5.

Continuously monitor how you feel about stage 4

6.When you can role play this forward as in stage 4 without the detection of the slightest emotion or desire to ‘tweak’ any part of your plan you will have the basis of a great plan.

7.

Understand that the use of your imagination is your most powerful asset in convincing the subconscious that you are in a NON-threatening situation.

8.

Role-play this in your mind every day, preferably on the morning of the trading day and ensure you detect no emotion or conflicts.

Reporoduced with permission from The Learning To Trade Forums

Learning how to loose is one of the most powerful skills that a trader can possess.

“Ah! Yes I know what you mean…every losing trade takes you closer to the next winning trade” Well…this is one of those sayings that seem to have an ‘air of wisdom’ about them and like I said in the heading, “trading sayings are dangerous”

Traders suffer an 80/90% failure rate, that is they start trading, learn a bit about technical analysis and then set about trying to devise a way to avoid losing, in an attempt to make money.

Some of them master this completely, by becoming so paranoid that they don’t place any trades at all, or just miss endless trading opportunities.

Making losing trades is vital to your success as a trader, without them you simply cannot advance at all.

So, how do you approach the task of making consistent controlled losing trades?

The first part is acceptance. Successful traders have accepted at a subconscious level that losing is on exactly the same scale as wining. Once this shift has taken place within the trader it will have a profound impact upon your trading results. It will set you completely free from any emotional attachment to that trade.

Side note:

Most traders try to detach themselves by endless strategy development, via the change or trimming of ‘perceived’ trading indicators. This is at best a waste of time if the subconscious is not involved in the process.

So how does a trader persuade the subconscious to accept this completely alien concept?

Well first we need to understand a little of what is going on in this truly amazing part of us located between our ears called the subconscious.

One role of the subconscious is the fight or flight response, that is; do you stand and fight or do you take flight?

This fight or flight response is a survival mechanism that kicks in EVERY time you are in a ‘threatening’ situation.

For the trader this is where 90% of the problems lie, because if any aspect of your trading causes even the most minute reaction, to the automatic fight or flight response, the chemical reactions start to kick in and you are lost in a sea of indecision and fear.

Think of it like this; imagine jumping out an aircraft with a lump of silk attached to your back for the very first time, then fast-forward to jump number 1,000

On jump 1,000 you would have having a wonderful time, maybe even a few tricks on the way down.

The point I am trying to make here is that when the situation you are in, is a know quantity, for example you are ‘comfortable’ with the outcome, then and only then are you free to experience fully the moment you are in, or the action you are carrying out.

The difference between making 1,000 parachute jumps and taking 1,000 trades, is crucial to understand, the difference is one of constants, when jumping there will always be a set of constants. With trading EVERY trade outcome will always be a variable.

This means than unless you persuade your subconscious that these variables are completely NON threatening, you will always be disadvantaged as a trader because of the chemical reaction of the fight or flight response.

There are two ways in which the trader can take positive actions to remove this ‘threatening’ concept form his/her trading. Today I will deal with just one, as the other way warrants a complete and detailed explanation in its own right for which we do not have the room here.

Removing all threatening aspects from your trading.

The trader needs to devise a plan, not to win trades, but how to lose trades trade in a controlled manner. The losing should take place in a systematic and repeatable method for every trade.

Now before you think I have gone barking mad here, I want you to really think about the trades you have taken to date.

I want you to be totally honest with the answer to the question. “Did you KNOW for certain that any one of the trades you took was going to produce a profit?”

If you answer yes to this question then I know already you are not a very successful trader. Because there is not a successful trader in the world that KNOWS his/her trades are going to be profitable. Your ego may like to think you knew but the fact is you did not.

A consistently profitable trader is a trader that treats every trade the same at a subconscious level, that is, the trading opportunity just holds an equal possibility of loss or gain; nothing more than this.

The successful trader is NOT looking for winning trades, because they don’t exist, (they only exist historically) the successful trader is looking for opportunities to put his trading plan into action.

So in summary then.

1.

Devise a plan how to lose trades in a controlled and consistent manner.

2.

Ensure that you can live with this plan in terms of draw down and any other relevant aspects of the plan

3.

Now in your imagination play this plan out to see how it feels.

4.

Now play this plan out over your next 15 trades as if they are all losing trades

5.

Continuously monitor how you feel about stage 4

6.When you can role play this forward as in stage 4 without the detection of the slightest emotion or desire to ‘tweak’ any part of your plan you will have the basis of a great plan.

7.

Understand that the use of your imagination is your most powerful asset in convincing the subconscious that you are in a NON-threatening situation.

8.

Role-play this in your mind every day, preferably on the morning of the trading day and ensure you detect no emotion or conflicts.

Reporoduced with permission from The Learning To Trade Forums

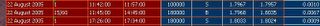

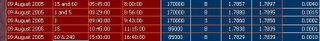

tues / wed

Tuesday was a tough day for anyone i think - with a range of only 60 pips on cable in a 24 hour period im sure thats probarbly been the worst day of the year so far for trading.

Yesterday only faired slightly better thank to the long opportunity that showed itself. also took some on EJ with a hilda signal.

You may be interested to know that this week is officially the worst this year as far as trading volume goes and august as a whole is usually the worst month of the year due to holidays etc

catch you tomorrow

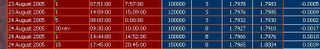

Monday, August 22, 2005

New week

fair day today for a monday which is usually crap - could be a good sign for the week ahead.

Three trades - 2x 1min and a longer term 15/60 trade for a total of 86 pips

As i close tonight the market is looking to go long again from 1.8000 however it's out of my accepted trading times so ill just let that one go - cant be stuck to a screen all day AND all night can ya! (not if you want to keep a wife!)

Hope you all had a great day and made plenty of pips from todays moves.

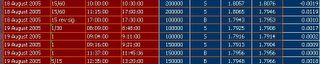

Friday, August 19, 2005

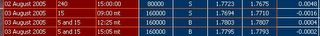

Thurs / Fri

Yesterday i was out much of the day so didnt get much trading done - however the trades that happened are listed above. scott was the star yesterday for getting in on the big one down which was well signalled - shame ya closed early scott :)

Today's trades are mainly one minute trades and next week ill be taking lots of them and seeing what can be made purely taking the 1 min entries where the perfect setup exists. Should be fun and a lot of pips to be had.

the week has ended on +194 - just about average with 16 trades of which 3 were losers and 12 winners and 1 break even.

hope youve had a fair week and come out positive :)

Thursday, August 18, 2005

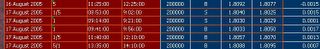

16th and 17th

as previously stated 16th was a poor day for cable - yesterday was much the same however a lot of 1 min entries were presented for good money.

personally i wasnt trading these yesterday i was building a short position based on the daily chart which ive now changed my mind on and closed out this morning for 9 pip overall lol

So far today ive took a few 1 min trades but again cable is in the 'dangerous' zone

i wont be trading much today as i have another hospital visit with my wife this afternoon, ill log the trades as i see them tho in the log for tomorrow.

have a good day y'all

Tuesday, August 16, 2005

Tuesday - im going mad!

well, today has just been awful for cable hasnt it. The wise wouldve left it well alone today although im sure many have made money.

There have only been 2 hilda trades on cable worth taking that being a brilliant 4 hour / 1 hour trade that happened before i got out of bed (well done andre for taking that) and the next one was a 30 min/15 min short at 10am mt time short which didnt present itself as a low risk opportunity so wasnt taken.

only one official hilda trade on the 5 min was at around 11:25 long 1. 8092 - this failed for -15 pips

spent the rest of the day looking for opportunities that werent there whilst at the same time missing golden hilda calls on EJ and swissy.

nuff said - im calling it a day PAH!!

There have only been 2 hilda trades on cable worth taking that being a brilliant 4 hour / 1 hour trade that happened before i got out of bed (well done andre for taking that) and the next one was a 30 min/15 min short at 10am mt time short which didnt present itself as a low risk opportunity so wasnt taken.

only one official hilda trade on the 5 min was at around 11:25 long 1. 8092 - this failed for -15 pips

spent the rest of the day looking for opportunities that werent there whilst at the same time missing golden hilda calls on EJ and swissy.

nuff said - im calling it a day PAH!!

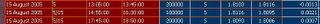

Monday, August 15, 2005

Blue Monday

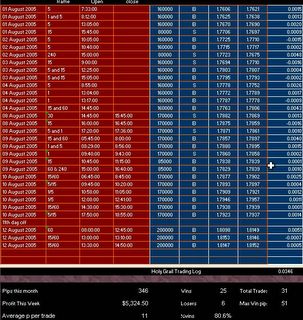

Saturday, August 13, 2005

Month to date

So far for august then 346 pips and 80.6% win ratio.

This week has been fun with a rather ranging market weve still managed to get some pips in - 191 pips for the week with a day out at that.

Shame that the daily signal on Thursday didnt pay off, next target for possible reversal is around 1.8270-90 and as the 1.8300 number is usually a bit of a price magnet then i'd say that was the one - then back down again. Time will tell of course and im not predicting the market just following the probabilities.

There are also suggestions backed up by the analysts that indicate a downmove to 1.64 in the next few months.

These dont really matter to me as im an intraday trader but as always best to be vililant when around these numbers.

I hope youve had a good week yourself and got some pips in the bank.

Friday, August 12, 2005

Are you setting yourself up for faliure?

I was asked to submit to an interview last week by a small online trading magazine.

One of the questions they asked me was 'what makes you successful at trading'

This is an excellent question that I'd like to expand on. And the answer to the question comes down to your own personal definition of success. Let me tell you a story.

In my past I went along to a seminar. There were only around 12 people at the seminar and it was all about increasing your business income.

To cut a long story short at one point the presenter went around the room asking if the delegates thought they were successful. When he got to one guy he asked 'are you successful' and the guy answered without a hesitation 'No'

The delegates knew this man was a millionaire. He had a large business empire, owned a yacht and was in all the delegates eyes probarbly the most successful one there.

Everyone looked rather shocked that this guy wasn't successful and awaited with baited breath what bad news he had about his company.

The presenter asked him a smart question 'what would it take for you to be successful?' the man answered almost immediately '100 million in the bank, a house on every continent and business increasing by 10% a year'

what this man was doing was setting himself up for failure from the start. I'm not saying that what he wanted wasn't possible, as I'm sure it is. But the guy had never had the feeling of success because he set his measure of that success so high. He had set his sights on a target that was so far away from what was immediately possible that even though he had wealth, property and a great business he never felt that his aims were achieved.

The question is ... Are you setting yourself up for failure in your trading?

Your definition of success is very important. For example many traders say to themselves that to be successful they must get 30 pips per day. That might not seem unreasonable but it is setting yourself up for failure.

For the first few days the trader gets their 30 pips a day and feels successful - on day four he only makes 10 and so a psychological process begins - to keep up this success the next day he needs to get not 30, but 50 pips to make up for the day before.

unfortunately he takes a risk too far and actually loses on the day 10 pips so tomorrow he must get 90 pips to get back on track.

This continues as the trader gets more and more unsatisfied and feels a failure every day even if he makes money because he's not meeting his success criteria.

don't make the mistake of setting yourself up for failure and set yourself an easier definition.

So, when I was asked the question 'what makes you successful as a trader' I answered 'because I make money'

My own definition of success is that every week I make more money than I lose. This way even an increase of 1 pound in my account means I've had a successful week, means I feel good about my trading and means I feel successful and confident.

Hope you enjoyed this :)

Thursday, August 11, 2005

Wednesdays Trades

yesterday was a good day for the system - cant put my hands up to taking tham all and missed the best one as was training at the time on another pair.

However 67 pips for the day is cool.

Hilda says that we have reached the top of cable at 1.8005 or thereabouts on a daily chart and should expect a retrace to around 1.77 at least before any further upmove.

It will be interesting to see if this comes off as ive never really studied hilda on a daily chart.

Im out all day today so i wont be taking any trades or reporting back. As such, and just to test out hilda, i have a small short position from 1.80 - it did already go some 30 pips into the green and as such any hilda player wouldve taken some profit before it came back for another pop at the top. Im going to leave this one in though with a stop at 1.8050 just to see how it fares

Have a good day trading. I might just write a small article for you before i go on success definitions - if not then ill do it tomorrow or over the weekend.

Tuesday, August 09, 2005

Tuesday

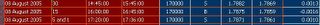

Another muggy kind of day in the markets waiting for the big announcement tonight - i wont be sat waiting for it, would sooner just trade the aftermath tomorrow

above are the offical hilda trades today - more pips couldve been taken on some of them but ive always been one for letting them run.

also took some other trades which arent listed here.

The first one at 5:30am MT4 time i didnt take as i was snoring but it was a classic hilda so ive included it in the list for those who trade the midnight hours (to us in the uk anyway) to have a look at - all times are mt4 time which i think is gmt+2

with the other trades i took today i came out with exactly 50 pips - not bad for such a poor moving day. Most of them were scalps and the ones not listed were hilda influenced anyway.

The people in the room are beginning to digest hilda now - i guess it takes longer than i initially thought to train but im happy to take as long as is needed and its fun anyway once they get over the mic shyness :)

if you are sticking around to trade the announcement tonight then good trading to you.

Monday, August 08, 2005

Monday aug 8th

Its been a tough day for hilda today - the initial move up wasnt signalled and on the usual timeframes we did not get a re-entry into the trend. There were in fact 4 possible entry points into the trend on the one minute chart however we were all busy looking for other trades on other pairs to see them on cable!!

Then we entered into a short of AUD at 66 only for it to turn into a paint watching excercise which we eventually closed for 4 pips (not listed above - only cable trades).

The cable entry above quoted at 14:45 MT4 time was one of our reversal signals which played out and we closed that and reversed in favor of a 15 min long signal setup that was stopped out for -15

final call was a 1 min scalping strat again on cable which turned out to be the last of the day.

overall not the most impressive day for the hilda system but then after the initial rise was missed then it's not that suprising.

Never mind - always more trades around the corner. Tke care and look forward to speaking tomorrow :)

Sunday, August 07, 2005

office layout

Well, heres the bnew office layout for your entertainment including usb fan to keep me cool on those hairy trades :) (click pic to enlarge)

The furniture is getting on a bit now - about 3 years old but hey, if its comfortable and productive then what the heck :)

all setup and running now anyway so should be a good attendance week for me in the market :)

Saturday, August 06, 2005

Fridays Fun

No trades yesterday as i spent the day putting together the new pc which is a MONSTER!!

ill try and post a picture of this stunning 5 screens i now have available :)

got to get setup with software etc but hopefully by monday all will be ready to rock and roll :)

take care and have a great weekend

ill try and post a picture of this stunning 5 screens i now have available :)

got to get setup with software etc but hopefully by monday all will be ready to rock and roll :)

take care and have a great weekend

Friday, August 05, 2005

Thursday, August 04, 2005

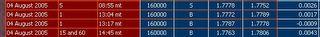

Thursday Trades

Ok, hope you've had a fair day today.

Been a really strange day hasn't it and im not saying we haven't had to work hard for these pips.

Hilda identified these trades today on cable alone and the figures are straight system trades. The first trade I personally closed out at +11 although if I had fully followed the system it would've made 26. Various reasons including the interest rate decision among others clouded my vision of the system and as usual I should've just followed her.

Then as the market was poorly we decided to take some 1 min scalps - 1 won and 1 lost.

other pairs have also done well today with brad capturing 100+ on EJ and CAD but if I was to report every trade opportunity it would take me ages just to log them.

All in all a good days trading for a personal +61 pips on the day on cable and a small loss of -12 on usd/jpy - never traded that before but it was a valid signal - cant win em all though eh?

Hope you had a good day too and pipped some into the bank.

Tomorrow my new PC comes - got to the point where my aging PC needs replacing so decided to buy a proper trading station - the price is really right too. - this might stunt my trading somewhat tomorrow as ill be getting it set up etc

If you're on the lookout in the UK (or anywhere for that matter) I cant recommend this fellow enough - here's the link to take a gander - and yes before you ask - the price does include the shuttle PC to run it too :) - and no, I don't get a cut if you buy one :)

http://tinyurl.com/9bm4k

Maybe in a day or so I will be able to join graham and duckfu in the latest craze of office photo's

have a great night and take care

Wednesday, August 03, 2005

Wednesday Blues

been out since 11 this morning on some personal business and only took one trade.

i closed the one from last night for a healthy priofit though and lost some on that first 15 min trade.

from what i see the market is awaiting the nfp on friday with this dark cloud over us and the trades shown are the hilda's ive visually seen on cable .

Cad did give some opportunities today tho and by far the best hilda was on the one hour cable chart at 6am uk time this morning - was fast asleep so didnt see it. well done sam for spotting that one but we were all getting some zzz's

its a great shame that the first training week for some has been this one. things will pick up after nfp tho we just need to be more selective in the run up to it.

Gonna be trading live with the guys all day tomorrow and seeing what we can eek out of the market.

till tomorrow byeee

Tuesday, August 02, 2005

Tuesday - loss at last!!

well, a loss at last lol. Not been a good day today 2 trades for -13 and one open on hilda - the official trade is the last one in the log - i took it early and really wish i hadnt cos i couldve maybe found some other trades whilst that one was sat there.

still, its open and there for the night - will be checking it as we go.

had our first training session today and everyone seems happy with it - time to see some results for them now though.

take care y'all and good night.

Monday, August 01, 2005

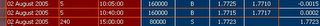

Monday 1st aug trades

Ok, here is todays trades on hilda - ive logged them all but i did not take the 13:05 myself as i was out of the office - it was there tho and plain as day.

4 trades for 57 pips - i took 3 for 37 pips

Tomorrow i will be training all afternoon so if you try and contact me and i dont answer then youll know why.

Hope you all had a good day and enjoy the rest of it :)

Subscribe to:

Posts (Atom)