Hi Folks - just took some time out to update the Grailtrading blog.

Have a very happy New Year - Catch you in 06 :)

The ravings of a mad forex trader and his twisted view on the world we live in

Friday, December 30, 2005

Friday, December 23, 2005

sorry

sorry, took off for lunch yesterday and didnt bother much after that - took 52 pips on the downmove though but hey! its close to Christmas and cant be bothered to post anymore :)

So to all of you, please have a great time this christmas - dont do anything i wouldnt do (plenty of scope there then) and i'll catch you all in the new year.

Grail will still be traded over the holidays so dont forget to check out the grailtrading blog on New Years Day to see if we reach our target on the one million pound experiment :)

Till then take care y'all

Merry Christmas and a Prosperous new year!

From The Desk Of ...

Soultrader

Thursday, December 22, 2005

Thursday 1st trade

09:18 short 1.7427 close +14

09:44 short 1.7416 close +6

From The Desk Of ...

Soultrader

Wednesday, December 21, 2005

Wednesdays Trades

took an overnight long 1.7544 closed +13 - was a trade from daily 100 bounce

10:40 short 1.7543 close +12 1 min slo

11:45 long 1.7521 close +6

14:59 short 1.7490 close +20

17:03 long 1.7320 closed +33 - off the 200sma 4 hour chart

17:03 long 1.7320 closed +33 - off the 200sma 4 hour chart

total for day +84 pips :)

From The Desk Of ...

Soultrader

Tuesday, December 20, 2005

Tuesdays Trades

closed yesterdays short for +61 pips profit

11:01 long 1.7619 1 min slo close +40

16:57 short 1.7592 closed +52

18:18 long 1.7547 close +10

18:34 long 1.753 close +3 and done for the day

total for day = +166 pips inc closing yesterdays trade

hope yours was as good

From The Desk Of ...

Soultrader

Monday, December 19, 2005

Back in action

Ok, back in action today for the holiday week :)

Was diagnosed with diabetes so shit happens and ill now deal with it. There is an upside - I get free prescriptions now and I can also raid the diabetic chocolates at Thornton's (make ya crap a lot though :)

Thanks for the comments and birthday wishes anyway - much appreciated.

This week ill be taking it steady with trading - mainly looking for the longer timeframe trades on the run up to xmas. I like Christmas and I'm starting to get into the mood now so will be doing things around the house and the longer trades facilitates this.

Last night I went short cable @ 1.7684 with a stop at 1.7755 this is a 4 hour slo trade - looking for 1.7555 and a possible bounce point there. The trade might last longer than a day or two as the daily is setting up for a slo north BUT it may keep on going as this sets up to the weekly 200sma.

time will tell.

From The Desk Of ...

Soultrader

Wednesday, December 14, 2005

Happy birthday to meee

Happy Birthday to meeee

Happy birthday to meeeee

Happy birthday dear soulieeeeee

Happy birthday to meeee

Yep, that time of the year again and another year older - 42 now!

Ive had a wonderful birthday present - turns out i might be diabetic - having been ill of late i went to the doctors yesterday - ive been on steroids for a week and antibiotics for one thing and another and my vision went a bit blurry - Ive got a 42" plasma and i was watching the snooker and couldnt read the names of the players across the bottom!

Anyway, the nurse gave a slightly weird look and asked for a sample which i duly gave - there was sugar in it.

this morning on my birthday i had to go for a blood test and i should have the results by Thursday so ill let you know when i do.

Im starting to recover now from this virus so it will soon be time to start blogging again.

Trading wise ive had a fair 2 weeks but i just have not had the energy to deal with emails, blogs etc i should start back on the blog on Monday i think - still cant be arsed at this point.

catch you all soon :)

From The Desk Of ...

Soultrader

Monday, December 12, 2005

still poorly

sorry, still unwell with this flu / cold thing - check back later in the week

From The Desk Of ...

Soultrader

Tuesday, December 06, 2005

Poorly day

Not very well today - got some kind of virus. Went to docs this morning and now on steroids and antibiotics!!

4 trades two for -20 and 2 for +28 - cant concentrate so going to have the rest of the day off to sleep and recuperate i think myself lucky to have finished up for the day the way im feeling

will update tomorrow if i'm on.

From The Desk Of ...

Soultrader

Monday, December 05, 2005

Mondays Trades

Been a very difficult day today - the UK waiting for the pre-budget statement from Gordon Brown made the market almost stagnat.

the morning session revealed no opportunities whilst the afternoon identified many poor trades - I full expected to finish off in a negative position today and it was a pleasant suprise when i added them up. Here are the results

all times GMT+1

14:15 long 1.7381 close -2

14:24 short 1 min slo 1.7377 close -10

14:57 long 1 min ss 1.7401 close -6

16:05 short 1 min slo 1.7396 close -5

16:41 short 1 min ss 1.7377 close full +25

17:12 long 1 min slo 1.7374 close half +12 rest +9

17:25 long 1 min ss close break even

17:34 short 1 min entry into 5 min slo 1.7384 closed -10

final tally +5 pips

From The Desk Of ...

Soultrader

Friday, December 02, 2005

Friday Close

Ok, had enough today -buggar all this morning but had some fun with nfp this afternoon.

went long at 1.7291 and closed half at +75 the other half at break even believe it or not - was hoping for this to go position trade- the weekly chart looks to me to be a good long position - last weeks chart ended with a hammer bouncing off the 200sma and providing we can close above 1.7286 today we should be in for a higher finish next week. I dont think it will be a proper trend reversal on the weekly as the monthly still bearish but i think this will see a bounce for the next week or three PROVIDING that we close above 1.7286 tonight.

I also took an added trade at 1.7355 which closed -10 based on a one min slo

so for the day +50.5 pips full up and for the week +205

have a good weekend

From The Desk Of ...

Soultrader

Thursday, December 01, 2005

Thursdays Trades

Well, what looked like a promising start turned into the usual pre NFP day blues .

very little tradng this afternoon and just about fell asleep!

Trades: all times GMT+1

08:50 long 1 min slo 1.7287 cloase half +10 rest +14

9:28 long 1 min ss 1.7316 close break even

09:37 short 1 min slo 1.7312 close break even

10:51 long 1 min ss 1.7318 close break even

11:19 short 1 min slo 1.7318 close +10

14:00 short 1.7301 closed +10 (damn)

14:51 long 1 min slo - (dodgy tho) 1.7270 close half +10 second half +10

14:59 short 1.7278 close +3

total = 45 pips full up

hope you did better

From The Desk Of ...

Soultrader

Wednesday, November 30, 2005

Wednesdays Trades

Missed a few this afternoon whilst managing my other grail trade

The grail blog will be updated today with the months results and overview - check here after 6:30 http://grailtrading.blogspot.com/

Here are my intraday trades today:

All times GMT

08:52 long 1 min slo 1.7196 close half +10 rest +21

09:26 short 1 min slo 1.7219 close half +8 rest +8

10:14 long 1 min slo 1.7213 close half +10 half +5

11:40 short 1 min slo double top so slightly riskier 1.7242 close -9

16:21 long 1 min slo 1.7275 close half +10 second half +48

17:12 short 1 min slo 1.7316 close all +2

17:25 long 5 min ss 1 min lh 1.7307 closed +8 full pos

17:38 long 1 min slo 1.7318 - close half +10 half +5

Total = 68.5 pips full position

Could have done better actually - some positions I closed too early (check the chart and see) and some I missed late afternoon. Still a good day's work for me

From The Desk Of ...

Soultrader

Tuesday, November 29, 2005

Tuesdays trades

All times GMT+1

08:24 long 1 min slo 1.7251 close half +12 second half +4

09:10 short 1 min slo 1.7260 closed -3

09:45 short 1 min slo 1.7258 close -3

11:11 long 1.7229 - pre emptive trade to get into the 15 min slo off the pivot at 25 - took half at +10 added to position at 43 and closed the lot off at 44

17:57 short 1 min slo 1.7198 close half +15 half +10

total = 55 half pips = 27.5 full position.

I did spend several hours away from the office today so to be fair it wasn't too bad. whilst I was out I missed two good entries on the fall but c'est la vie!

hopefully the rest of the week should be free and clear

From The Desk Of ...

Soultrader

Monday, November 28, 2005

Mondays trades and thoughts

Been a hard day for me today - best trade of the day I closed for piffle when I should have held the second half for the run up - cost me dearly as you can see.

also on some trades I didn't take half at 10 - its the run down on Friday that made me wary where I closed for 10 and then it went another 60 odd pips

I must discipline myself to take the 10 and let the other half run to conclusion or decide just to take 10 full up on everything. with the win / loss ratio of this method taking 10 every time is a good option but means you see pips slip away from you. Psychologically its better to take the 10 every time rather that let the half run because your account grows quite nicely - but when the big runs come it gets painful.

add to that the fact that I'm still not out of the mindset where I always let the winners run - this take profit malarkey is all new to me - bunny girl used to harp on about it - it feels good on the poor ranges when you snatch 10 time and time again but it's a bloody nightmare when you take 10 from an 80 pip run like today

also let you know that I had a limit order in at 1.7040 - this was loaded to the hilt with funds for the bounce off the weekly 200sma - look how low it got!! a pesky 7 pips short of my entry!!

Still, a winning day is a winning day and good things come to those who wait....

All times GMT +1

08:40 long 1 min slo 1.7098 closed -5

09:26 long 1 min slo 1.7061 closed break even

11:28 short 1 min slo 1.7099 close break even

11:40 long 1.7099 5 min slo close +3

14:06 long 1 min slo 1.7107 close break even

14:26 short 1 min slo 1.7202 close half +10 half +1

15:06 long 1.7200 close half +10 rest +7

15:34 long 1 min ss 1.7209 close -7

16:16 long 1 min slo 1.7212 closed half +10 rest +8

= 28 half pips = 14 full up

From The Desk Of ...

Soultrader

Friday, November 25, 2005

Fridays Trades

End of the day then, time to tidy up the blog

Today has been a brill day for the trades setups as follows

all times now GMT+1 to match my MT charts

08:45 short 1 min ss 1.7291 close half +10 half +16 (26 halves)

09:31 long 1 min slo 1.7186 close half +10 2nd half +15

10:03 short 1.7192 closed all +10

12:05 long 1.7201 1 min ss close full +10

14:37 short 1.7212 1 min lh slo - close +10

15:05 long 1.7212 5 min ss close full +10

15:28 long 1 min ss 1.7219 close -3

15:33 short 1.7217 close full +10

17:30 long 1 min slo 1.7164 -10

so thats 125 half pips = 62.5 pips full position

for the week +147

have a good weekend :)

From The Desk Of ...

Soultrader

Thursday, November 24, 2005

Thursday's Trades

08:48 long 1.7229 close half +10 half +4 = 14 half pips

10:46 1 min slo short 1.7235 close +5 (10 half pips)

10:54 short 1 min slo 1.7269 close half +10 half +16 ( 26 half pips)

13:02 long 1 min slo 1.7243 close all +10 (20 half pips)

13:35 long 1 min slo 1.7244 close full +10 (20 half pips)

14:36 short 1 min slo 1.7248 close +10 (20 halves)

15:18 long 1 min slo 1.7243 close -5 (10 half pips)

total for day 100 half pips = 50 pips full up, not bad for a generally crap day :)

From The Desk Of ...

Soultrader

Wednesday, November 23, 2005

Tuesday, November 22, 2005

Tuesdays Trades

another poor day for me but positive - ive got so bored today that I missed the last two trades!

so for the day:

08:22 short 1.7156 1 min slo close half +12 half +31 = 43 half pips

10:42 short 1 min slo 1.7123 close break even

14:37 long 1.7088 close break even

15:55 long cable 1 min slo 1.7117 close half +10 - half +3 = 13 half pips

= 56 half pips = 28 pips full up

catch you tomorrow

From The Desk Of ...

Soultrader

Monday, November 21, 2005

todays trades

All times gmt

07:59 short 1.7176 1 min slo - closed half +14 seconf half -5 = 9 half pips

09:37 long 1.7202 1 min ss - closed -8 (-16 half pips)

08:58 Short 1.7192 1 min slo close 1.7200 -8 (-16 half pips)

09:56 long 1.7202 5 min ss - close break even

13:54 long 1.7204 closed half +10 half +20 = 30 half pips

14:44 short 1.7229 1 min slo - closed +2 (4 half pips)

15:36 long 1.7196 1 min slo - close break even

= +13 half pips = 6.5 pips full up

wowee, i guess ill retire forever on that!

the market is crap - taking the rest of the day off, going to an exhibition tonight of powerful sound kit so im off - waste of time trading this bucket of crap

hope you had a good day

From The Desk Of ...

Soultrader

Saturday, November 19, 2005

The Week Ahead

Ok, time for my weekly rant then.

The one hour chart still has room for more downside testing the lows of last week then along with the daily chart chart which is showing some positive divergence and an extreme cci for an upward pop to 1.7230 possibly even 1.7500

More downside is seen reaching for 1.7000 which is the 200 sma on the weekly chart - here it should find some support and may hang around here for a day or two.

I dont think it will hold, the monthly chart is convincing me that a run down to 1.6654 is on the cards before Christmas or soon after but we may well see a significant rise before that comes as the 200sma on the weekly causes a bounce

as always this is for entertainment purposes only and does not constitute advice to buy or sell - trade what you see.

The one hour chart still has room for more downside testing the lows of last week then along with the daily chart chart which is showing some positive divergence and an extreme cci for an upward pop to 1.7230 possibly even 1.7500

More downside is seen reaching for 1.7000 which is the 200 sma on the weekly chart - here it should find some support and may hang around here for a day or two.

I dont think it will hold, the monthly chart is convincing me that a run down to 1.6654 is on the cards before Christmas or soon after but we may well see a significant rise before that comes as the 200sma on the weekly causes a bounce

as always this is for entertainment purposes only and does not constitute advice to buy or sell - trade what you see.

Fridays Trades

ok, those of you who check regular will know i post throughout the day - time to tidy up the posts now

will try to do my weekly overview tomorrow

all times GMT

08:14 short cable 1min 1.7121 closed +2

first trade did actually run to target - never mind

long 1.7116 closed half +10 - 2nd half break even

9:55 long 1.7125 1 min slo - closed -4

12:38 short 1.7154 30 min ss closed +20 full pos

13:49 long 1.7137 1 min slo closed half +10, half +1

14:44 Long cable 1.7202 1 min ss - close break even

15:00 short cable 1.7203 closed half +25 (missed +10 was writing an email lol) second half closed +43

16:15 Long 1.7161 5 min ss pre emptive closed -20

took this one way too early for a shitty price really - thought i'd got rid of preempting trades but obviously not

16:28 long 1.7144 1 min slo close half +11, 2nd half +7

17:07 - short 1.7154 1 min slo closed -3

thats it so ...

97 half pips = 48 pips at full position - very good day today for the trades - lots of them and mainly winners - wouldve been a better day if i hadnt pre-empted that shitty 5 min trade - that was 20 pips full money down the pan. still, shit happens and i made it all back and more by the end of the day.

Market is crap now so ill be back with the weekly view tomorrow - hope you had a good day :)

From The Desk Of ...

Soultrader

Thursday, November 17, 2005

tidying up!

just doing this post to capture all todays posts and clean up the blog - will delete the posts now and out them into one

08:40 Long 1.7180 1 min trade slo - close half +10 2nd half +12

08:59 long 1.7192 1 min ss - close full +4

09:16 ss trade - too fast for entry - currently flat

09:31 short 1 min non system based on lower high 1.7210 closed half +10 half +2

10:05 short 1.7193 1 min slo closed half +10 half +15

long 10:33 1.7186 1 min slo closed for break even

14:40 long 1 min ss 1.7185 close -5

16:15 - short 1 min slo 1.7203 close break even

prob last trade of the day results 62 half pips = 31 pips for the day

been a hard day for trading today - like walking in treacle

glutton for punishment tho so back tomorrow :)

From The Desk Of ...

Soultrader

Wednesday, November 16, 2005

last trade of the day

executed one last trade for the day

Buy gbp/usd @1.7172 17:23 gmt based on 5 min chart setup - closed half at +10 and rest at break even - pips = +10 half position (5 pips fully loaded)

catch you tomorrow :)

From The Desk Of ...

Soultrader

first trade of the day

First intraday trade today

Short cable 1.7308 10:30 am GMT - took half @+10 then went shopping :) - came back at 12:45 to find trade still open - trailed it on 1 min chart after that. closed @ 1.7176

If I had not gone shopping I would've been out earlier as my 1 min trail would've kicked in. - so for today just a single trade - half for +10 and half for +132

I'd like to take this time to discuss my new approach to taking half profits at +10 and today seems a good day to talk about it as its one of those days where it would have been prudent to leave it all running.

In the past ive been a staunch supporter of never closing anything early - the premise being that those trades that do run and run pay for the ones that don't.

All the great authors say you shouldn't close early because you are in effect 'cutting your winners short' and its a good point. On anything 5 min chart and above I'd agree with this but when you start to fall in love with a one minute chart things begin to change.

30 pips is a good run on a one min chart and runs larger than this don't happen too often. If you trade the one minute chart try this - make a diary of how many times you take a trade that goes to +10 and then you let it slip back to say +1 or even worse back into the negative territory. My guess is that you'll find that if you took all the +10's you had you would be making many more pips - until of course that 200 plus move comes along at which point you begin to kick yourself.

The thing is that every one of us needs to feel confident and satisfied that we are adding to our account rather than losing out on pips.

Taking +10 with half your position and then moving the stop to BE on the rest gives you a quiet serenity knowing that you wont lose on this trade whatever happens. You can then calmly trail the price with a stop on the 1 min chart peaks and troughs to its natural conclusion when the trend ends.

You see there is so much confusion in the thing you read. Every trading book you will ever come across tells you 'let your winners run' - well, in my mind any pillock can say this without justifying it - they don't answer the next question which is 'how far?' - lets face it, every trade of more than 1 pip in profit is a winner - its as much of a winner as a 100 pip trade or even a 200-300 pip trade - when do you stop and take your money?

At 200 pips in profit do you let the winner run?

the take half scenario allows you to do both things. Take some profit and let the winner run.

So the question then is where do you take profit - well to work that out decide on the timeframe you are going to trade and work out not what the average move is - but what it nearly always does. On a one minute chart and the setup I use this is about 10 pips. For your take half you need to look at your trades and see a pip value that your trade makes at least 70% of the time on a winner - don't count the losers cos they lose anyway.

Using this method a few weeks ago in a ranging market I took over 120 pips on a day that nothing was happening - just 10 at a time and let the rest run on a peak / trough trail.

I think I'll re-open the blog to comments - whilst they remain intelligent I'll let you have your say and I'd love to hear your comments on this subject.

Hope this helps.

From The Desk Of ...

Soultrader

Tuesday, November 15, 2005

Home from away

Just to let you know I'm back from hols

will be posting just as soon as I delete the 1700 emails in my mailbox!!

Had a good time on holidays and have come back refreshed - seems my mind is not yet up to the task of staring at 5 monitors all day long - after about 3 hours today I got a stonking headache.

managed 3 trades today though for 30 pips in between the chaos, hope you've had a good one :)

From The Desk Of ...

Soultrader

Friday, November 04, 2005

Update

Sorry for the total lack of updates of late and there wont be any more for the next week or so.

Im off on holiday on Monday for a week in the sunny climbs of Gran Canaria.

Before i finish off today (friday) ill be placng a long position trade on cable with the view that on Monday or Tuesday we will see a turn in the market which will break new highs by the end of the week - for those who are part of the hilda crew just take a look at the daily chart on the new setup weve been convering this week and you'll see why im looking long.

The position will only be small relatively speaking at £5 a pip with a stop at 1.7370 which is see as below major major support

im in now - whilst writing this, entered at 1.7500 - the 7370 stop is a risk of 130 pips for £650 with a target of 1.8200 = 700 pips = £3500 so r/r on this trade is around 5:1 if target is met - dont think it will be hit by my return, a more expectant figure of 1.80 will do

back on Tuesday 15th so keep an eye on the trade for me wont ya :)

From The Desk Of ...

Soultrader

Monday, October 31, 2005

sorry, no weekend report

apologies for the lack of a report at the weekend but im off on holidays soon for a week and just had too many things to do..

First tho to let you know that my Grailtrading Blog has been updated with the results for October 2005.

during the week ill send some trading updates and thoughts with the email publisher.

all the best for now.

First tho to let you know that my Grailtrading Blog has been updated with the results for October 2005.

during the week ill send some trading updates and thoughts with the email publisher.

all the best for now.

Saturday, October 22, 2005

Week - Ending 21/10

been a tricky week for Hilda and a good week also - had several great days on the system, I however spent 3 days of it trading a long on cable that started Wednesday afternoon and finished Friday for +162 pips. Add that to the early week results and I took +227 for the week. Did suffer some losses this week though and Hilda's stats for October have dropped to 75% on the one and five min charts

Lets have a look at my weekly lottery guesses lol

I said that on Monday / Tuesday we should see a test of the trendline at 7600-7620 which it did - but then it continued and broke the 7570 area - when it did this it did indeed continue for more downside until Tuesday when we saw a close double bottom at 7420 - I didn't expect the downside move to go that low at all

I gave a sticking point of 7810 for the upside move and it stopped short of that at 17998 on Friday before the drop.

Ok, lets have a look at the coming week.

On Sunday / Monday I see a rise to begin with pausing for breath at 7720 ish - this is a crux number - if she breaks to the upside then we will see new highs and the start of an uptrend.

Before this happens I see price playing a game of ping pong between 7720 and 7640 / 7601 but it may well just go for the break immediately

Before this happens I see price playing a game of ping pong between 7720 and 7640 / 7601 but it may well just go for the break immediately

so - two scenario's

If we head north:

topside first resistance seen at 7820, 7997, 8110 and finally 8377

if we head south:

support seen at 7610, 7594, 7560, and then a clear run to 7250

hope you've had a good week

As usual this analysis is for entertainment purposes only - trade what you see :)

From The Desk Of ...

Soultrader

Monday, October 17, 2005

Monday - what a day!

Well, for a Monday it's been a hell of a day hasn't it. Long one for me though and started very early.

In fact I couldn't sleep at all last night - I had the usual Sunday afternoon nap which just went on far too long and when it came time to go to bed I was wide awake. So, with the wife happily snoozing upstairs I opened my charts - the market seemed to be moving well and I caught a reversal from 1.7651 to 1.7705 for 20 pips and then went long from 81. closed that one too early though for just 8 pips to give me a total of 82 before bed - decided to quit whilst I was ahead and get some sleep.

then I overlaid and it was 8:30 before I got to the pc.

I made the dreaded mistake that most traders do and thought I was well in 'the zone' and proceeded to give back 34 of the pips I'd made - well, you know the story.

before I really got into self destruct (yes, we all do it) I took a break for a while and came back to start regaining them. tentatively I took a short from 7591 and got em back plus a bit more - although I did close too early.

for the day its +87 and I'm retiring happy that at least I didn't give the whole lot away!

Everyone is starting to feel the market might go long now, but we are expecting lots of bad news out of the UK this week so don't hold onto any beliefs that the market has had enough of short. - just a heads up is all, trade what you see not what you think :)

back tomorrow

From The Desk Of ...

Soultrader

Saturday, October 15, 2005

Blog Notes

Note that from now on I will no longer be providing specific trade by trade analysis of the hilda signals as this is done daily in our trading room as the day unfolds. I may also be working on a members area of the http://www.simpleforexsystems.com site to log the trades for system users to check.

The blog will be returning to its former use as daily thoughts and comments on the market with overviews on trades taken for each day.

The past week has been a brilliant trading week for me personally. Lots of trends in both direction as the market begins to make its mind up to whether to initiate a trend change or not.. Its been that elusive one week a month when ive been really in tune with the market. I'm sure that this happens to you also, you know what I mean? everything just drops into place and you cant go wrong.

I'm not saying I haven't had losing trades but they have been very few and far between. As I trade mainly using a one minute chart to pinpoint entries its very easy to see when you've got it wrong and exit very quickly. I cant remember the last time that I had a loss of more than 10 pips on a singe trade trading in this way (note that this statement does not include the trades off the grail system)

My results for the week are +218 pips for 28 trades, 21 of which were winners for 270 pips and 7 losers for -52 pips which gave me a personal win / loss ratio of 75% and an average of 8 pips per trade after spread.

In the room this week I concentrated on training a specific trading setup on a one minute chart. This subject will again be the main thrust this coming week as it's imperative that this one thing is embedded into our traders minds. Ill continue to hammer this home until the users recognise this happening automatically as it is core to taking safe entries from signals given on the higher timeframes.

If you are a member of the group reading this then you'll know what I'm referring to and for those who cant get to the room I will try really hard to deliver our 4th video this week which will concentrate on this setup.

The Week Ahead

Friday finished with the four hour and daily charts breaking their trendline which has been in place for a month now since 12th September and the good news is that the day closed above it.

The next step in this potential trend change is for the trendline to be tested. This should result in a drop sometime Monday or Tuesday to test the break level around the 7600 - 7620 area. Its possible price could go as low as 7570 before a bounce up - if it doesn't bounce from this area then we should see more downside however I don't think this will happen.

following the test we should see a rise with a potential sticking point around 1.7810 - 20 as cable struggles to break the highs of 6th October. Next potential sticking point is around the 7880 level and 7905 will be very difficult to break.

if we see 7950 this week then it should be a good setup to see price rise to 8330 next week.

as usual please note that these are not trading recommendations and you are responsible for your own trading decisions

That's it from me today - have a great weekend.

From The Desk Of ...

Soultrader

Saturday, October 08, 2005

Oct week one

been a very hard week for me this week. broken pc, pc rebuild and its amazing how many small pieces of software that you add to make life easier isnt it - took a bloody age to get most of em loaded.

Im probarbly about 60% of the way there but enough to continue business 100% now anyway - the rest will be added as and when i need em.

hilda signals from this week are below - bit of a tough week to trade but ive identified and trained the users on am easy way to trade the 1 min chart in a ranging market.

Hilda has an easy way of identifying a ranging market and also tells you when one is forming. as the market ranges most of the time then it was a good idea to find a way to range trade it. This appeared in the form of a pattern and hilda combination so this week im going to concentrate on this in the training room and also get another video done for it.

Lets look at my predictions from last week:

i said ...

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

well, the prediction for the rise was correct although my first barrier was broken the prediction of 1.7800 was within 13 pips of the weeks high (it reached 1.8013) this took longer than i expected as i did say tuesday - however the fall finally came on Thursday and did indeed make new lows so i think i was pretty damn good on that one :)

the week ahead:

The weekly chart ended on a doji so based on that it's anyones guess as to where the week will end. The monthly chart is still set for an upmove but not to new highs - this will take about 3 or 4 months to complete taking us to february in the new year. 1.8663 is my prediction for a top on the next swign up on the monthly chart - lets see at the beginning of 2006.

The daily shows more downside to the week ahead making new lows again possibly this week down to 1.7300.

The 4 hour chart suggests a rise to 1.7679 on monday before the downside for the week drops into place.

thats it, lets see what happens :)

Obviously the analysis on this page is merely for entertainment purposes only and should not be taken as investment advice - in other words its most probarbly bollocks. :)

take care and check in during the week.

Im probarbly about 60% of the way there but enough to continue business 100% now anyway - the rest will be added as and when i need em.

hilda signals from this week are below - bit of a tough week to trade but ive identified and trained the users on am easy way to trade the 1 min chart in a ranging market.

Hilda has an easy way of identifying a ranging market and also tells you when one is forming. as the market ranges most of the time then it was a good idea to find a way to range trade it. This appeared in the form of a pattern and hilda combination so this week im going to concentrate on this in the training room and also get another video done for it.

Lets look at my predictions from last week:

i said ...

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

well, the prediction for the rise was correct although my first barrier was broken the prediction of 1.7800 was within 13 pips of the weeks high (it reached 1.8013) this took longer than i expected as i did say tuesday - however the fall finally came on Thursday and did indeed make new lows so i think i was pretty damn good on that one :)

the week ahead:

The weekly chart ended on a doji so based on that it's anyones guess as to where the week will end. The monthly chart is still set for an upmove but not to new highs - this will take about 3 or 4 months to complete taking us to february in the new year. 1.8663 is my prediction for a top on the next swign up on the monthly chart - lets see at the beginning of 2006.

The daily shows more downside to the week ahead making new lows again possibly this week down to 1.7300.

The 4 hour chart suggests a rise to 1.7679 on monday before the downside for the week drops into place.

thats it, lets see what happens :)

Obviously the analysis on this page is merely for entertainment purposes only and should not be taken as investment advice - in other words its most probarbly bollocks. :)

take care and check in during the week.

Thursday, October 06, 2005

Sorry!!

Well, ive just setup the blog so I can just email to it - should be cool but I don't think that pictures work.

Ive not had chance to hardly trade or make any reports in here - On Tuesday morning I came into the office to find that the motherboard and processor was totally fried on my main pc.

No, email, no trading, no nothing.

so had to go and buy a new pc from the wholesaler and then spend the rest of the time installing etc - that's what ive been doing - no fun I can tell you. The pc had been used for 2 years now and it's amazing how much stuff you find to make life easier so its been murder getting it all on.

I'm about half way through it now but still a shedload to do - some will have to wait until I actually need em - who said computers made life easier????

Soultrader

Saturday, October 01, 2005

Month End

Stats for the Month of September are below.

Before i analyse those and cover last weeks predictions just to let you know that the grailtrading blog has now been updated here

Ok, so last weeks predictions - how did they do?

Before i cover next weeks prediction lets have a look at the hilda signals log below. September was a great month and the addition of the new trade setup has indeed increased the win / loss ratio of hilda. Important thing to note is that this is only an addition and those of you trading hilda should not disregard the basics of the core system.

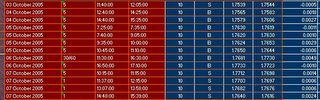

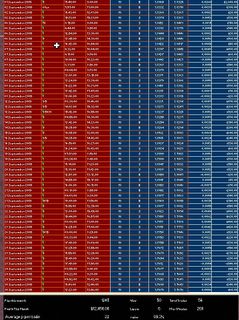

1245 pips for the month and an 89.3% winning ratio on what i call 'low hanging fruit' trades.

Hopefully you can see the sheet below by clicking on it - afraid i had to zoom out somewhat to get them all on one screen

Ok, onto the week ahead then.

The daily chart suggests to me there well may be more downside to the start of the week, although the chart is fighting one of the indicators in use. The weekly is showing signs of flagging but still has the potential to more downside.

We have a new monthly bar on the monthly chart which does show a setup for long. However price is in the 'dead zone' as i call it and so could in effect go either way. However if i had to make a prediction and throw my hat in the ring i would say that October will finish the month higher and a close to the month above 1.82 would signal that the current downtrend is over and the monthly uptrend will resume.

So, the week ahead

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

there is an upmove on the cards and this week may be a hard week for intraday trading as we are at a decision point wether to initiate the move this week or next week.

Of course this analysis is all bollocks and no-one can truly predict the market - so please dont take any of this as anything more than a bit of fun - trade what you see as it unfolds :)

Hope you have a great week ahead

Before i analyse those and cover last weeks predictions just to let you know that the grailtrading blog has now been updated here

Ok, so last weeks predictions - how did they do?

- a possible retrace to 1.7910 - tuesday - way off the mark - market did retrace but only to 1.7800

- new lows should follow any lift - correct

- Possible lows of the week 1.7350 - way off the mark 1.7565

- possible highs 1.8120. - again way off the mark

Before i cover next weeks prediction lets have a look at the hilda signals log below. September was a great month and the addition of the new trade setup has indeed increased the win / loss ratio of hilda. Important thing to note is that this is only an addition and those of you trading hilda should not disregard the basics of the core system.

1245 pips for the month and an 89.3% winning ratio on what i call 'low hanging fruit' trades.

Hopefully you can see the sheet below by clicking on it - afraid i had to zoom out somewhat to get them all on one screen

Ok, onto the week ahead then.

The daily chart suggests to me there well may be more downside to the start of the week, although the chart is fighting one of the indicators in use. The weekly is showing signs of flagging but still has the potential to more downside.

We have a new monthly bar on the monthly chart which does show a setup for long. However price is in the 'dead zone' as i call it and so could in effect go either way. However if i had to make a prediction and throw my hat in the ring i would say that October will finish the month higher and a close to the month above 1.82 would signal that the current downtrend is over and the monthly uptrend will resume.

So, the week ahead

This week will begin with yet more downside. Many traders are now bottom picking the market but that does not mean they are right. The setup on the 4 hour chart should play out sometime on monday for shorts although the initial hours of the first day may see upside before the drop

Monday - rise to 1.7680 before fall - if this doesnt happen and we see new highs then 1.78 will be the magic turning point on tuesday / wednesday - by magic turning point i mean a break of 1.78 will see a trend change in the making and if it bounces down from 1.78 then we are in for new lows and a continuation of the downtrend for the week.

there is an upmove on the cards and this week may be a hard week for intraday trading as we are at a decision point wether to initiate the move this week or next week.

Of course this analysis is all bollocks and no-one can truly predict the market - so please dont take any of this as anything more than a bit of fun - trade what you see as it unfolds :)

Hope you have a great week ahead

Subscribe to:

Comments (Atom)